Columbia Sportswear CEO: Our stock price reacts to weather in Manhattan

Correlation or causation? I take a look ...

I’m resurfacing this post from mid-December last year—back when G2 Weather was just getting started—because this weekend’s snowstorm in New York City puts the signal back in play.

Cold weather in NYC has historically mattered for Columbia Sportswear (NASDAQ: COLM), particularly during peak winter selling windows.

Bullish? Possibly—but context matters.

I’ll break down what’s changed this season, and which retailers are actually benefiting from the late-December cold, in Monday morning’s G2 Weather Flash—including an updated read on holiday winners and losers.

Many years ago, I met Tim Boyle, the CEO of Columbia Sportswear.

We talked about the weather.

Of course we did. We’re both in the business.

I don't remember the exact date, but I know it was the mid-2000s. Tim was running the business then, but his mom—known to the world as Ma Boyle—was still the chairwoman and very much the face of the company.

She was one tough mother …

I digress here, but I love this story from COLM’s website:

In 2010, Gert Boyle was returning to her home one night when a strange man appeared in her driveway. Approaching her in the shadows, he offered her a fruit basket and asked for an autograph.

Moments later, the intruder brandished a gun and ordered the 86-year-old face down on the ground, attempting what police later identified as a plot to kidnap her for ransom.

But her would-be captor didn’t get far. Before he had the chance to do anything, Gert managed to summon the police to her home, convincing her attacker she needed to disable the alarm system and instead pressed a panic button. As the police were wrapping up the crime scene work, the local chief of police arrived.“How are you doing?” the chief asked Gert. “I was doing great until you showed up wearing that North Face jacket,” she replied.

Two days later, she was back at work.

Tough mother, indeed.

Back to the topic at hand: Tim’s appearance on CNBC and his joking-not-joking take on the relationship between COLM’s stock price and weather in Manhattan.

Here’s a link to his full interview on CNBC with my pal Carl Quintanilla:

“Frankly our stock price reacts to the weather in Manhattan”

Carl did a bit of a double take on Tim’s assertion (which I loved) but his logic is, in my opinion, valid-ish.

As he correctly notes, New York City, the financial capital of the world and headquarters for the U.S. financial industry has a huge number of stock traders.

New York—home to Wall Street, the New York Stock Exchange, and many of the world’s most prominent financial services firms—has by far the highest productivity of any state in the security and investment sector.

The state accounts for more than $100 billion of the total U.S. GDP in securities and investment, nearly three times the total for runner-up California. Within its own state economy,

New York also tops the list of states in terms of dependence on securities trading. Nearly half a million New Yorkers work in the securities trading industry, and the industry represents 6.39% of the state’s overall GDP.

Source: commodity.com

Animal Spirits …

Traders are people, too.

Despite the masters of the universe label, they live in the physical world and are, therefore, as affected by the weather as the rest of us.

The difference for them, particularly the ones that trade in retail stocks, is that a cold walk from the subway into the office or a weather forecast they get on their apps when working from home in Stamford can trigger a trading signal along with the typical "Mazlovian" survival instinct.

That is particularly the case if they are trading COLM.

It works something like this: "I'm cold. I need a coat. It's November. I'm buying Columbia Sportswear."

To test Tim’s theory I did a back-of-the-napkin test to see if there was any validity to the idea that cold weather in the northeast correlated to higher stock prices for COLM.

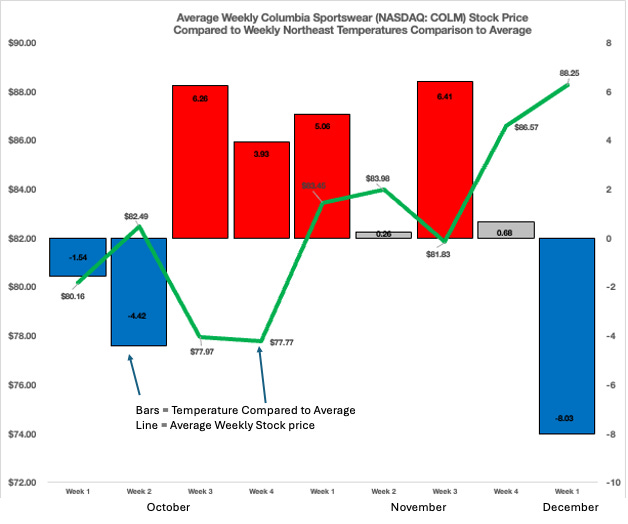

To do this (quick and dirty) exercise I compared the average weekly stock price for COLM against the temperature difference from normal for the northeast US climate region as defined by the National Weather Service.

The period covered is October Week 1 (week ending October 11th this year) through the first week of December (week ending December 6th).

The results confirmed (again, -ish) Tim’s hypothesis. As temperatures went down the stock price of COLM went up.

It’s of course not a perfect correlation and I’m sure card-carrying data scientists and analysts would throw up in their mouth a little bit based on my fairly crude analysis.

But come on, COLM sells cold weather gear. It got really cold after being incredibly warm against a comparison to very warm weather during the same period last year.

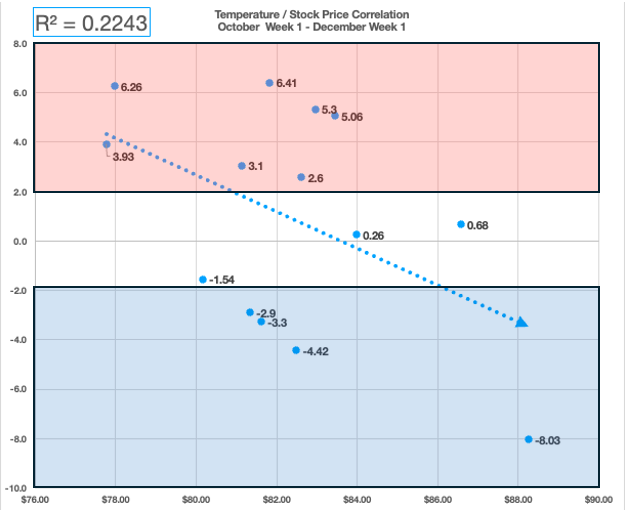

Based on this super small sample size it shows that about 22% of the change in the stock price for the period is explainable by the change to colder weather in the northeast, which, of course, includes the NYC metro area.

It doesn’t take a rocket or data scientist to connect the dots here.

So the answer to the question: did the colder temperatures cause the positive change in the stock price, for this period, and for this company?

I think it did … -ish.

For more on this topic below is another interview from Tim at the end of last year’s record warm winter along with links to academic research on this topic.

The Effect of Weather on Stock Trading

Effect of weather on stock market: A literature review and research agenda

Weather Effects on on Stock Market Returns in the United States

Does the weather affect stock market volatility?

Media & Attribution: Insights may be used with clear attribution to G2 Weather Intelligence.

© 2025 G2 Weather Intelligence. All rights reserved.