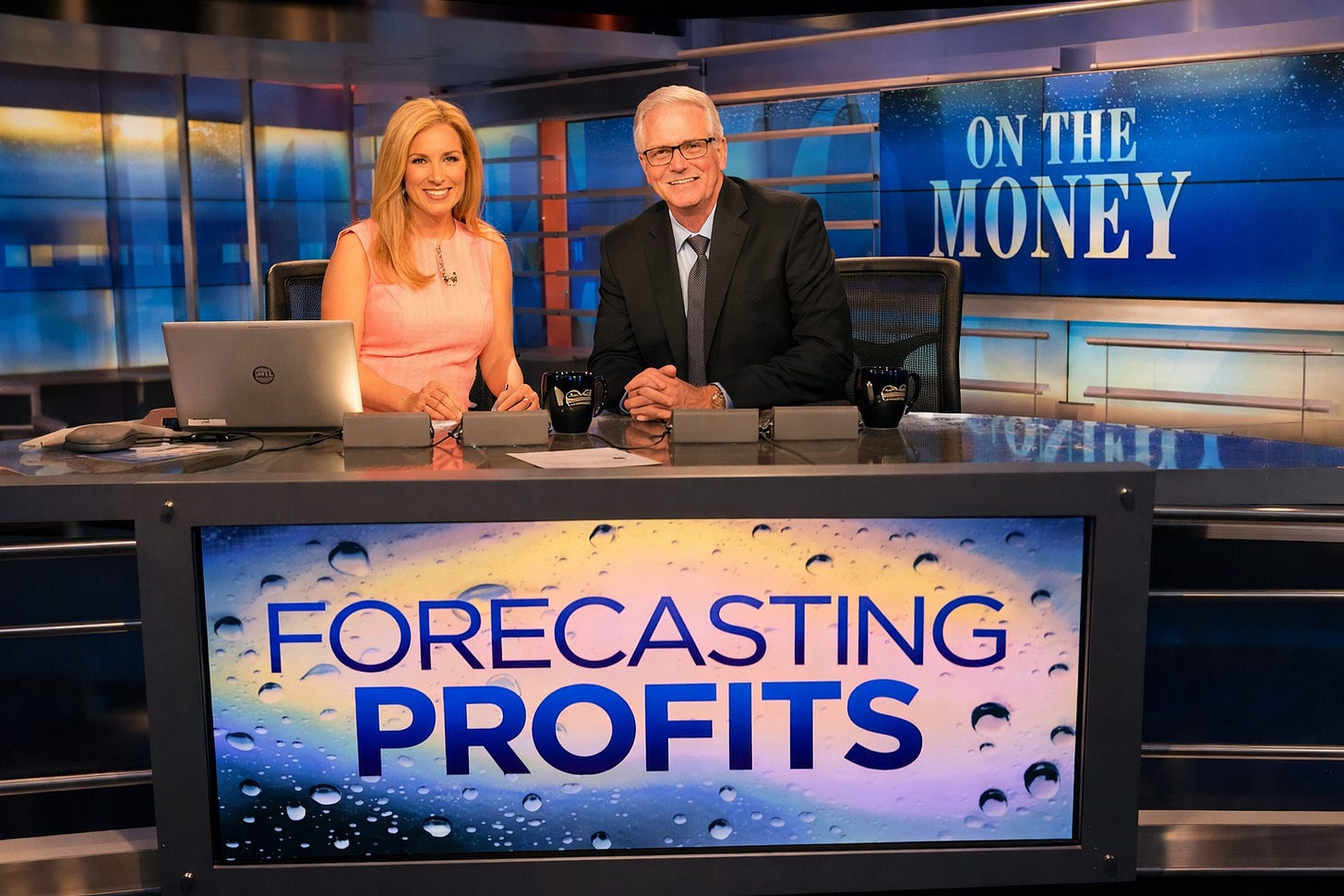

From Forecasts to Financial Signals: The Next Chapter of G2 Weather Intelligence

A sharper, more investor-relevant way to understand weather’s impact on earnings

“Paul Walsh is one meteorologist investors should pay attention to. His forecasts are not of the five-day variety … Walsh has helped retailers like Wal-Mart, analysts at Merrill Lynch and Citigroup, and several hedge funds turn weather into an opportunity, rather than a cost.” —Barron’s Magazine, The Polar Vortex Portfolio, Investing with Weather in Mind

This week, thousands of retail leaders gathered in New York for the National Retail Federation's (NRF) “Big Show.”

The conversations will sound familiar: agentic AI, demand sensing, personalization, real-time decisioning — and, as it almost always does at a January NRF in New York, weather comes up — typically as small talk, not strategy, and more noticeable this year because the cold never really arrived.

All of that matters. But it still misses an important point.

For most of Wall Street, weather is treated as background context. For most retail and restaurant leaders, it’s something you expla…