Ice, Not Snow: Why This Weekend’s Storm Puts Retail and Restaurant Earnings at Risk

Snow slows traffic. Ice shuts stores—and hits earnings.

Signal Summary — Ice Storm Retail / Restaurant Impact (Jan 23–26)

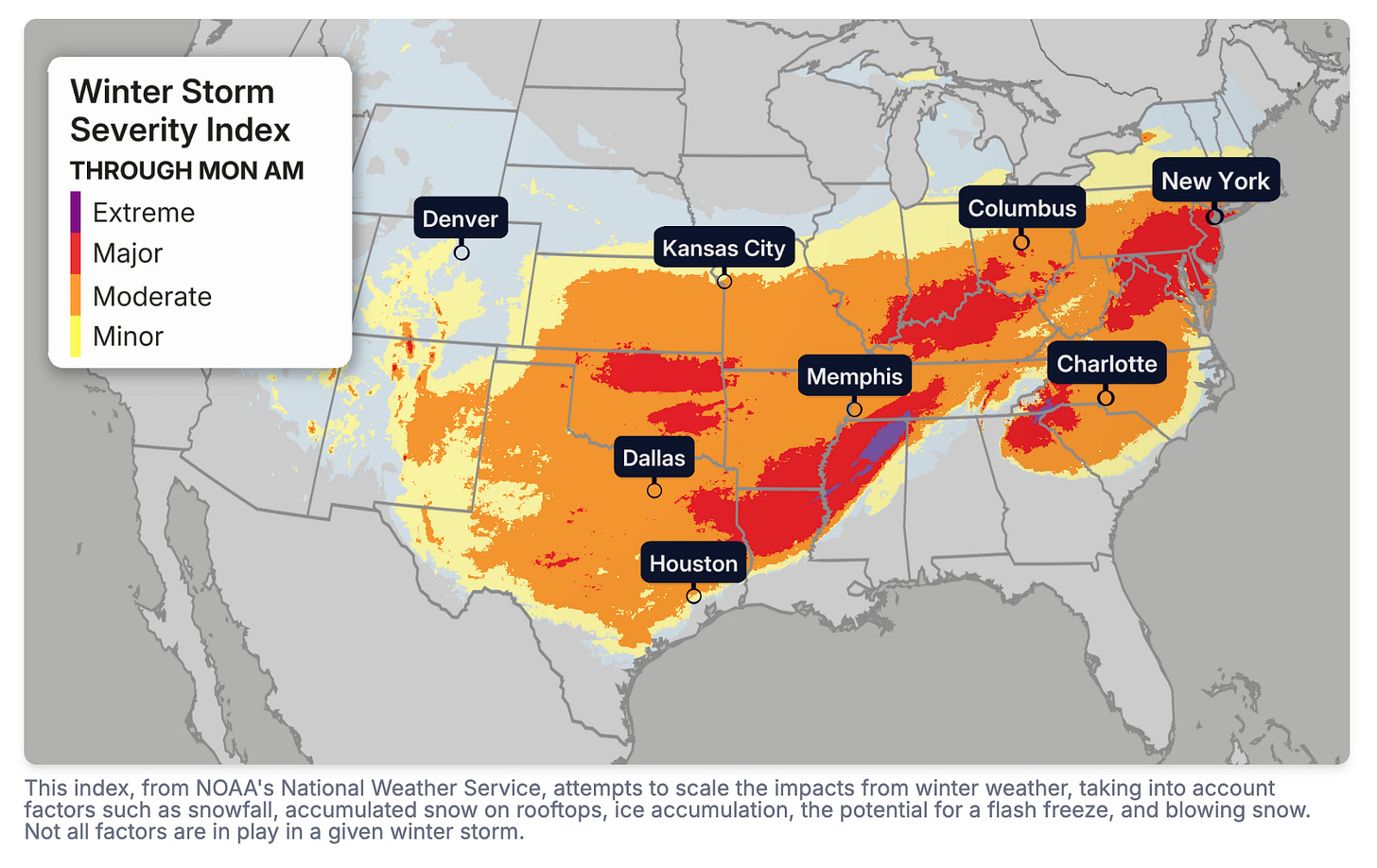

This is a snow and ice event—but the ice is what matters most for earnings. Snow slows traffic and shifts timing; ice disables infrastructure, drives power outages, and forces store closures. Snow disrupts demand. Ice shuts operations down.

Q4 earnings risk is highest for restaurants, specialty apparel, and department stores. These businesses depend on weekend traffic, have limited recovery opportunity, and face lost (not deferred) sales when roads freeze.

Grocers and home improvement retailers can benefit—if they can stay open. Pre-storm demand for food, generators, and emergency supplies is strong, but execution risk is high. Power loss quickly turns inventory into write-offs.

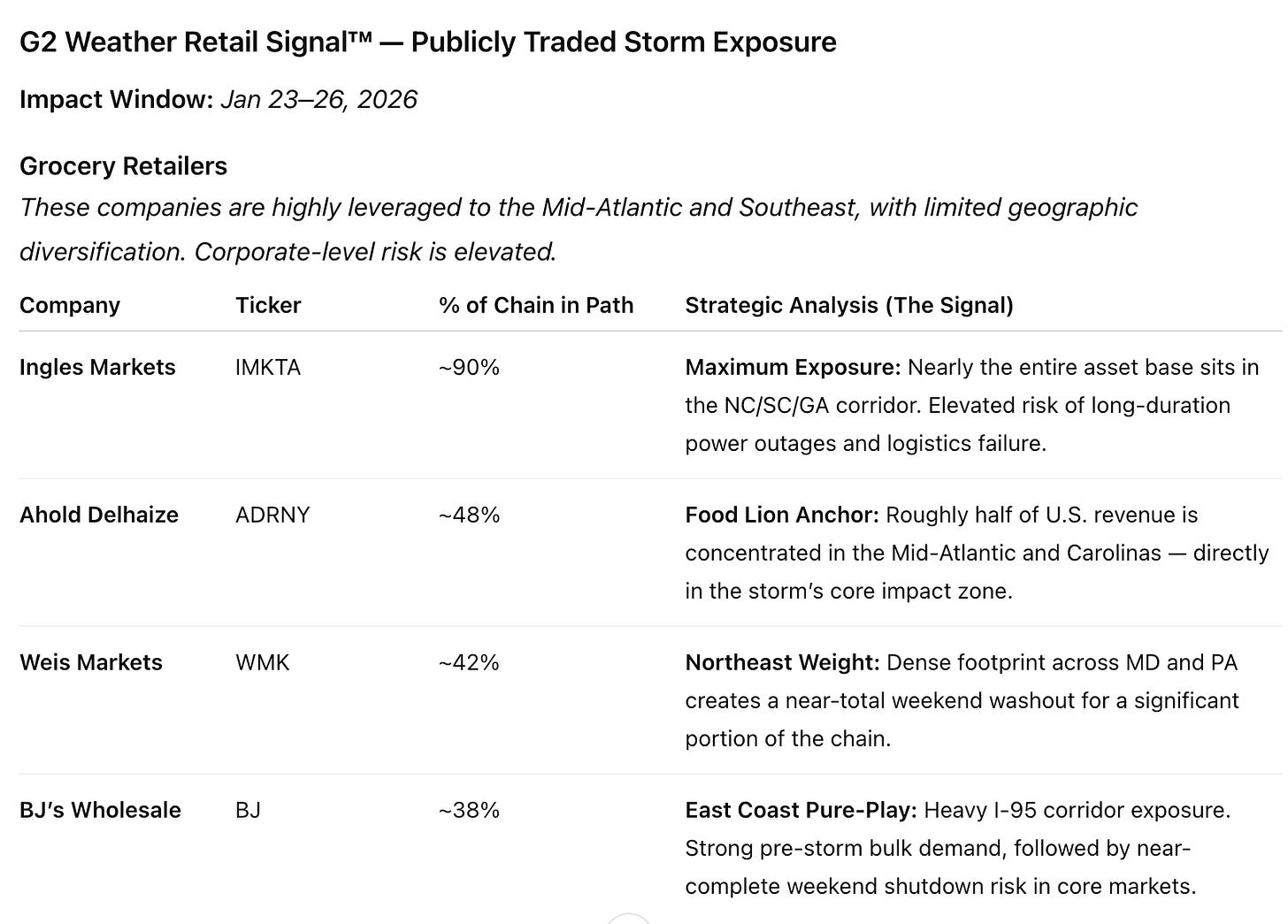

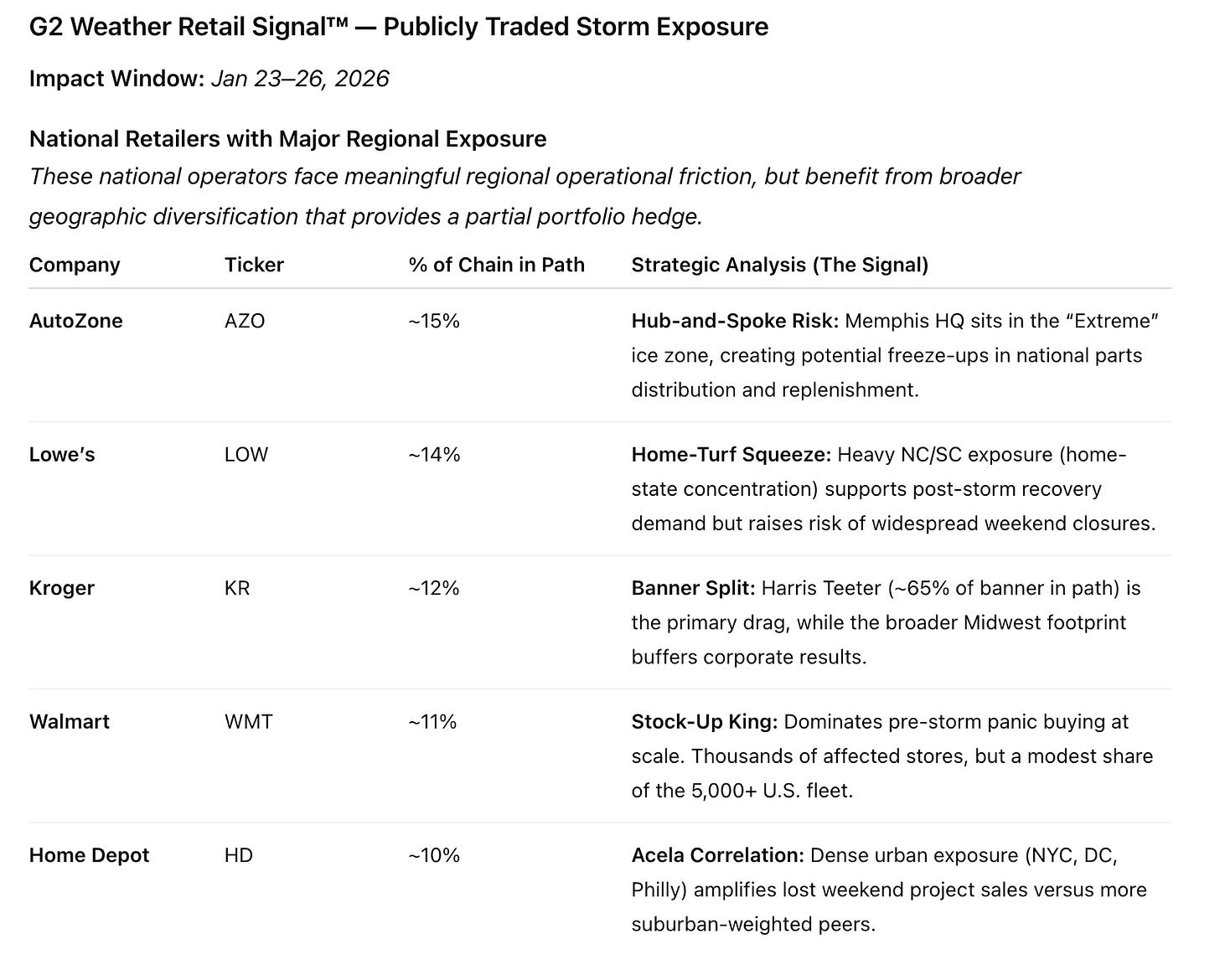

Regional concentration amplifies outcomes. Chains with dense exposure to the Carolinas and Southeast face asymmetric downside, while nationally diversified operators retain a partial hedge.

This storm doesn’t need to over-deliver to matter. Even moderate ice accumulation can create meaningful margin pressure, inventory losses, and adverse Q4 commentary.

I ran a quick screen this morning on the retail and restaurant names most exposed to the developing ice storm. This is likely just the first phase of a potentially historic event, with record cold expected to follow next week.

The combination matters. Ice drives power outages; extreme cold prolongs them. Together, they create a multi-day drag on consumer activity across some of the most densely populated regions of the country.

If outages are widespread and persistent, the impact won’t be limited to this weekend. Lost sales from Friday through Sunday are rarely recovered, and power disruptions layered on top of extreme cold could further suppress spending into next week. For exposed companies, that raises the risk of Q4 earnings downside, particularly if this weekend’s traffic is lost and operations remain constrained during the cold snap that follows.

The tables below highlight a select set of sectors and publicly traded companies we track at G2 Weather that appear most exposed to ice-driven execution risk. This is not an exhaustive list, but a representative snapshot of where the operational and earnings sensitivity is most acute as this event unfolds.