Stephen Weiss likes DKS quite a bit

Not that there's anything wrong with that ...

Over the next couple of weeks, I’ll be resurfacing a series of posts I wrote last November, right when I launched G2 Weather Intelligence.

These posts walk through how weather shaped retail performance in last year’s Q3 for many weather-affected retailers.

Re-reading them now gives us something valuable: a baseline. A comparison point. A way to understand how this year’s patterns line up — and why I expect weather to play a very different (and more favorable) role for retailers heading into earnings season.

There will be more context in each post as we go. But the headline is simple: last year’s Q3 headwinds are this year’s tailwinds.

Starting with DKS. They did well with last year’s weather. This year, they may get to run the same play with even better conditions.

DKS is positioned to grow. Not that there’s anything wrong with that …

Originally published on November 27, 2024

Back in the day, as the so-called "business and weather expert" on The Weather Channel, I was on CNBC relatively frequently.

Most of the time, it ended well.

But on one occasion, following an interview I did with the gang from Fast Money, the post-interview cross-talk resulted in a bit of awkwardness (and suppressed giggles) when Stephen Weiss commented that he likes Dick's ... and quite a bit.

To be specific, he was referring to Dick's Sporting Goods, aka NYSE: DKS.

Watch it here:

This happened many years ago (and it still makes me giggle), but two things remain true:

DKS is highly weather-impacted, and,

They're VERY good at managing the impact of weather.

Like Stephen, I also like DKS quite a bit, and, on the back of their latest earnings beat, the market does too.

Interestingly, DKS's geographic exposure to the weather was relatively similar to TGT's, yet the outcome was markedly different.

Of course, this is not exactly an apples-to-apples comparison, and Target has more exposure risk to seasonal apparel in Q3, but the difference in outcomes was particularly stark.

Interestingly, DKS management mentioned weather on their earnings call nine times, the same number of times that TGT mentioned weather.

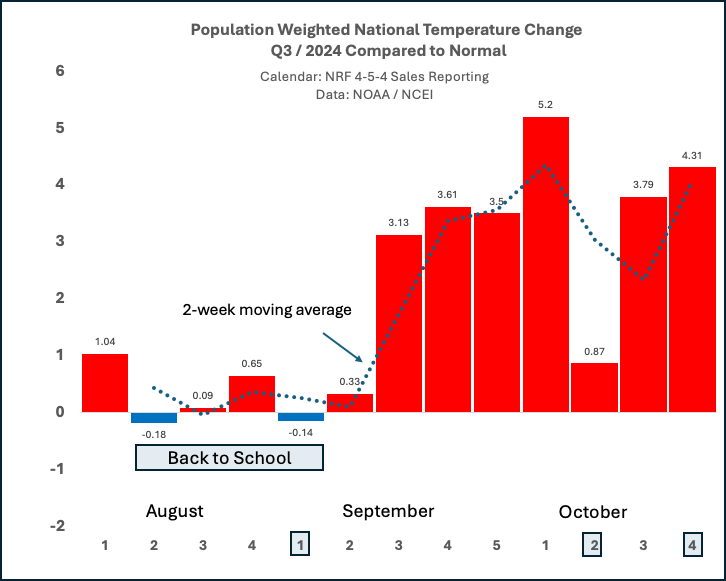

But in DKS case, the focus was on "really strong back-to-school" sales early in the quarter (when the weather was relatively seasonal), and they downplayed the impact of the warm weather in October. They were able to defy gravity.

Here's how Lauren Hobart, DKS CEO described it:

" ... we had a really strong back-to-school season, so that was obviously early in the quarter. We had great growth in footwear, apparel, team sports.

It was warmer than we might have liked in the last part of the quarter, but it didn't have a material impact on our comps. And we're being very excited about Q4."

And here was the (lightly edited) take from DKS CFO, Navdeep Gupta:

" .. just to add to what Lauren said, you see the puts and takes with the weather within our portfolio of categories. So if you see a softer performance in the cold weather categories, what you also see is some of the favorable trends in the categories that do well in kind of the moderate temperatures.

So for example, the golf business actually exceeded our expectations in the back half.

This is the reason we really like the portfolio of products that we have that interplay between these categories, you know, doesn't insulate us from the weather impact, but it allows us to navigate the month-over-month transitions as well."

I love the term "puts and takes" in this context. I usually refer to the effect of weather on consumers as an ebb and flow, but "puts and takes" is a new favorite.

The Outlook for Holiday

To quote Lauren from the Q3 / 2023 earning call regarding the then-upcoming holiday period:

"... we like cold. So, I'm hoping for a snowy Thanksgiving and Christmas."

From your lips to Mother Nature's ears, Lauren.

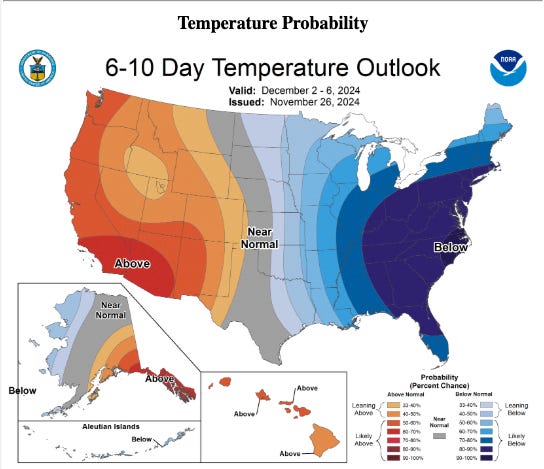

Colder-than-average temperatures (compared to historically mild weather in '23) and possible snow are on the horizon for at least the first week or two of the holiday shopping season across a large percentage of DKS's store base.

Given their outstanding performance in Q3—surprising on the upside despite a weather headwind—the weather outlook for Q4 looks particularly bullish for DKS.

Because I can’t help myself, here’s yet another CNBC DKS slip: “Nobody wants to talk about Dick’s?”