This Cold Snap Is a Test — Most Retailers Will Fail It

The lift is there. The window is short. If you're not adjusting in real time, you're already late.

“It is best to read the weather forecast before praying for rain.” - Mark Twain

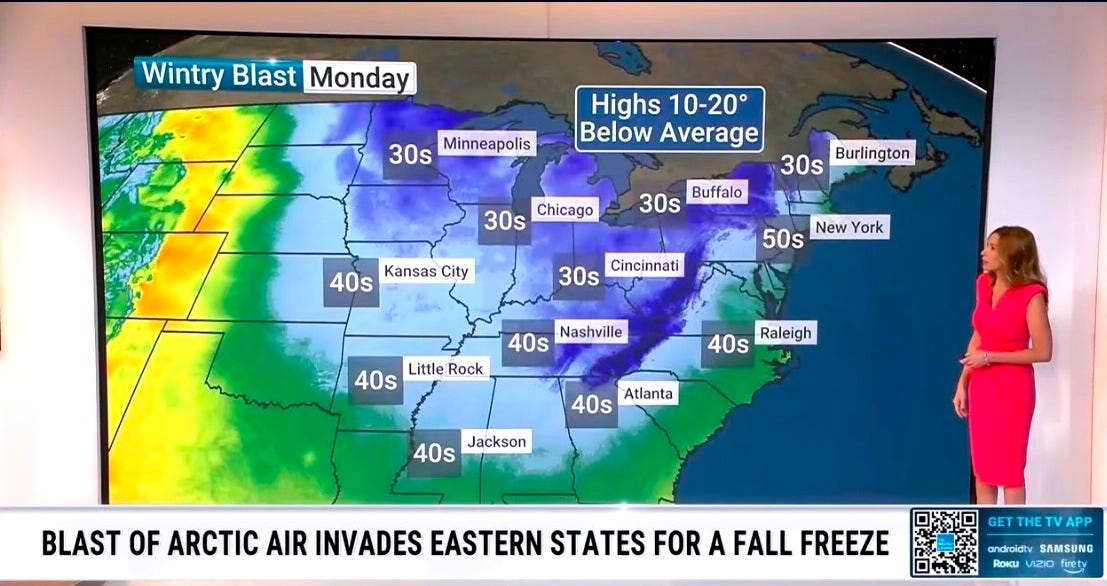

A sharp shot of cold air will sweep through the eastern United States this week. When that happens in November, it changes what people buy almost immediately.

People don’t buy winter because the calendar says so. They buy winter when the weather says so.

So yes — this cold snap will lift seasonal product demand across apparel, footwear, home heating, cold and flu OTC, and comfort foods.

But — and this is important — the impact may be brief and more muted than headline models might suggest.

Let’s break down why.